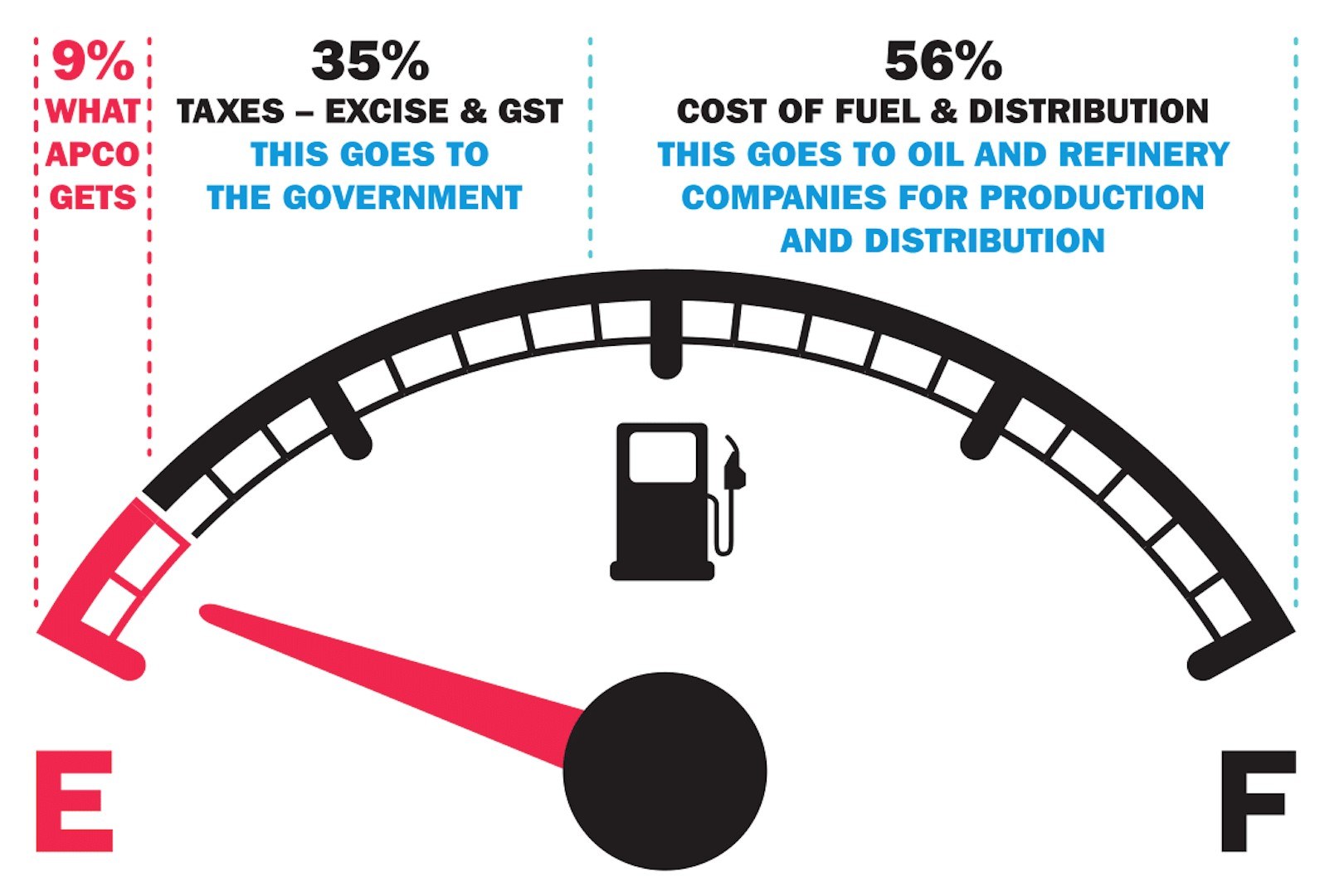

The cost of fuel and where your money goes.

We strive to provide our customers fair and honest fuel pricing. We understand that fuel is a major expense for our customers, so here’s some transparency as to where your money goes.

- 56% - Wholesale fuel and distribution costs.

- 35% - Fuel Excise & GST

- 9% - What APCO gets

Let’s break it down…

Wholesale fuel costs.

This is what APCO pays the refineries for our petrol and is the major cost when it comes to fuel. We also have to transport the fuel from these refineries to our APCO stores. APCO run’s its own distribution network – meaning cheaper distribution costs with these savings passed onto you.

Taxes.

We all pay taxes, and wholesale fuel purchases are no exception! A huge percentage of the cost of fuel is in the Government’s Fuel Excise and GST.

Fuel Excise is a flat tax by an Australia Government, indexed inline with inflation twice a year and is an additional tax to GST.

For a more detailed explanation, please see https://www.aaa.asn.au/advocacy/explainers/fuel-excise-explained/

What APCO gets.

APCO Service Stations gets what’s left over and there are operational costs that we have to cover before we achieve any profit.

APCO’s operational costs include:

- Running costs for a 24-7 business

- Wages and administration

- Property Rent and utilities – especially electricity and rates

- Maintenance and asset improvement costs

- Capital investment on properties, facilities and equipment

- Compliance and regulation

- Marketing and sales costs for operating convenience stores 24-7

As you can see, the cost of operating a service station leads to fuel being a very low-margin product. Hopefully, this breakdown has given you a clearer picture as to where your money goes when you fill up at APCO.

Why you should care.

APCO is committed to keeping fuel prices fair – for our customers and for APCO!

- APCO is proudly a local independent retailer. Australian owned and managed, every dollar you spend at APCO stays in Australia, creating local jobs, paying local taxes and delivering many other conveniences, services and products to the people of Australia in clean, safe, modern facilities 24-hours a day, 365 days a year.

- We want to, and aim to every day, keep petrol prices low, but the bulk of fuel price rises are outside our control and are largely influenced by external factors.

- Before you even get to the local service station, 85% of the fuel price is influenced by things that are very hard to control. Australia’s high fuel prices reflect the rising cost of crude oil on the global market, the declining value of the Australian dollar and the huge impact of the fuel excise tax and GST charged by the Government.

Government fuel excise and GST add significantly to the cost you pay at the pump.

- If you combine fuel excise and GST, roughly 35% of your fuel costs are going to the Government as taxes.

- If you pay $1.30 a litre on petrol, the government is taking 44.2 cents in tax out of every litre you purchase. That’s $35.2 in tax every time you fill the average 80-litre fuel tank.

- Every one-cent increase in fuel excise results in the Government collecting an additional $220 million a year in taxes (approximately).